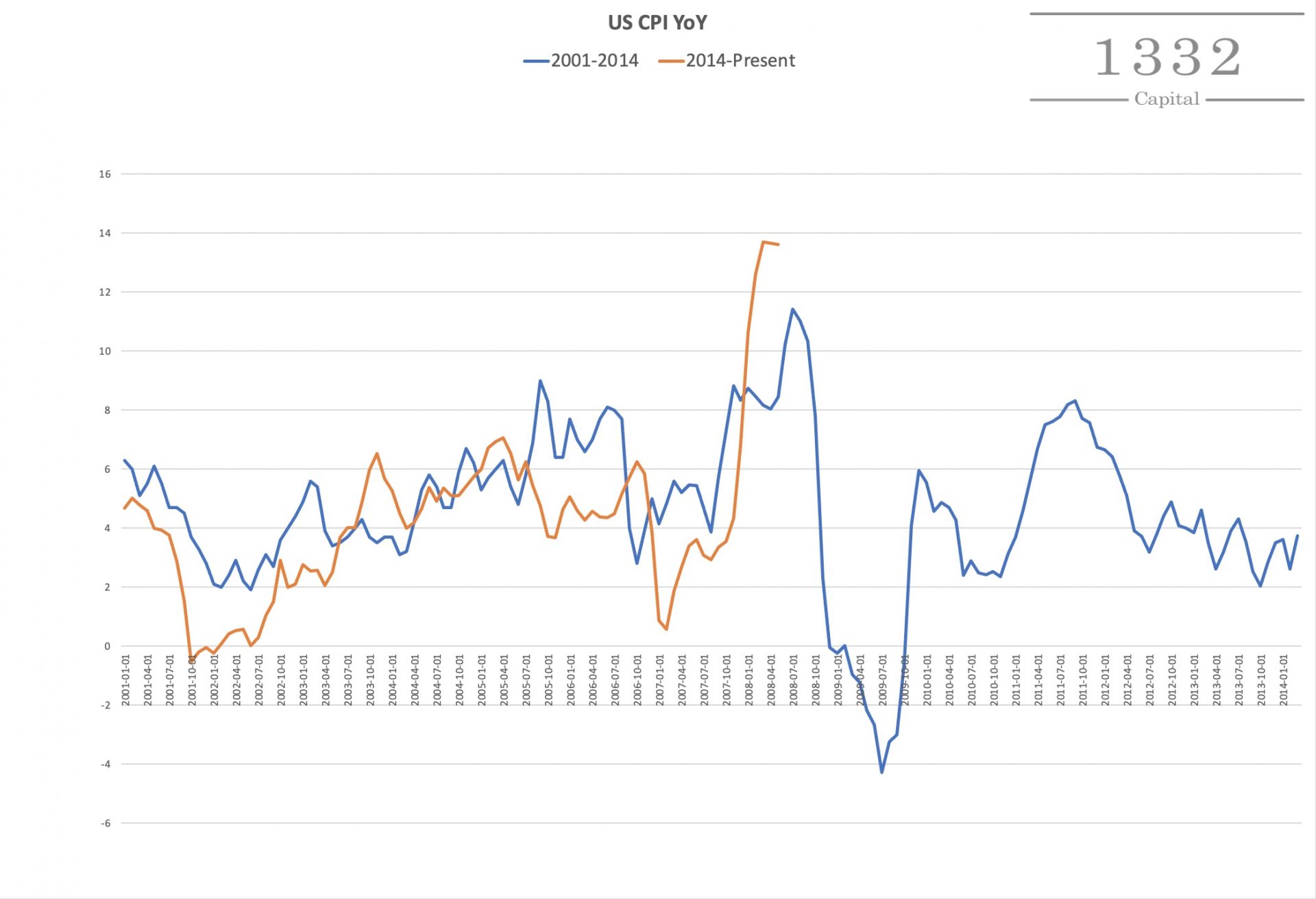

There is no doubt that commodity prices and overall inflation have soared since the Coronavirus lockdowns in 2020. A combination of base effects, quantitative easing, an exodus from cities and supply chain disruptions have lead to massive year on year changes in CPI.

The included image is an overlay of CPI from 2001 to 2014 against 2014 to present. While it may or may not be a spurious correlation, in a high indebted stagnating economy, rapid increases in prices can easily choke off growth and precipitate a recession. Prior to the 2008 financial crisis, this was a spike in oil prices.

The cure for high prices is high prices.

Certainly, there were other problems in the economy that led to the great financial crisis, but there are also problems with the current economic expansion. Despite the recession due to the pandemic, most companies have not deleveraged, division in congress may limit fiscal stimulus, the Fed may be about to tighten into an economic slowdown and situations like Evergrande may indicate that there are systemic risks internationally too. Over the next few quarters, we should see how sticky or transitory inflation is, and depending on the severity of the slowdown and the speed of both fiscal and monetary reaction we'll see if the deflationary forces win out over inflation.

Raw data can be observed at FRED: