This article won’t go into a detail explanation, but if you do the work to think through all the outworkings of a gold standard compared to the current credit standard, you’ll see that the difference between them is quite stark:

Gold Standard

- Savings

- Rewards Investment

- Long Term Planning

- Stable Growth

- Consistent Prices

- Values Labour

- Upward Mobility

- Supports Small Business

- Limited Local Bank Runs

- Environmental Stewardship

- Natural Consequences

- Allows Creative Destruction

- Democratized Economy

- Societal Freedom

- Yield Baring Assets

- Accurate Price Measuring

- Fair Interest Rates

- Real Businesses

- One Time Purchases

Credit Standard

- Debt

- Encourages Consumption

- Short Term Profits

- Exaggerated Business Cycles

- Inflation Leading To Deflation

- Over Values Capital

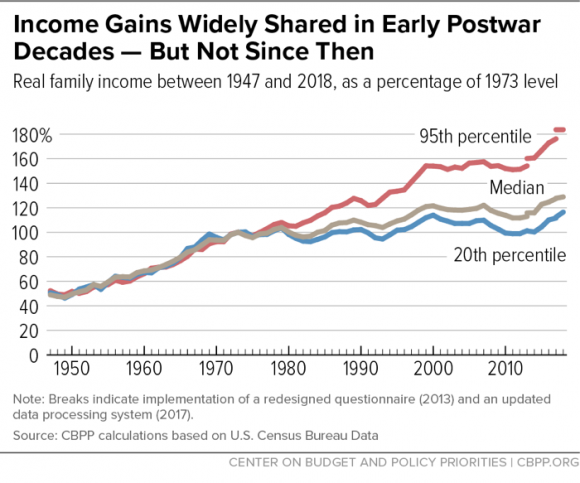

- Wealth Inequality

- Creates Monopolistic Oligarchies

- Systemic Financial Collapse

- Environmental Destruction

- Unintended Consequences

- Props Up Zombie Businesses

- Government Controlled

- Financial Repression

- Asset Price Inflation

- Distorted Price Signals

- Low-Interest Rates

- Financial Engineering

- Subscription Model