A recent article from the American Institute for Economic Research has been doing the rounds on Twitter for saying that we should no longer be teaching money as a store of value. While practically speaking that may be an accurate description of the current state of affairs, the negative effect of bank credit expansion and devaluation of fiat currency, should show us that to therefore teach that money shouldn't be a store of value is a grave mistake.

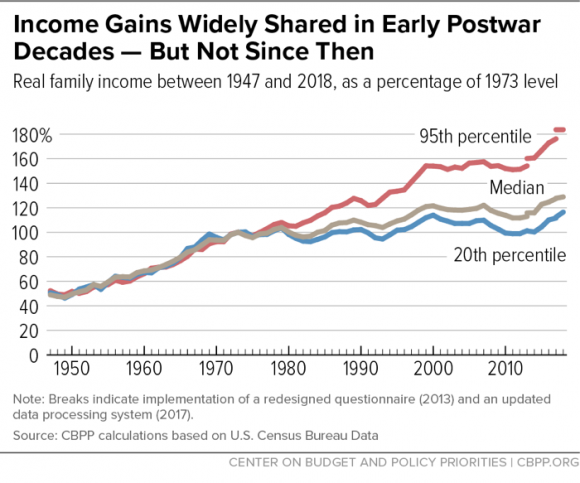

If money is not a good medium to long term store of value, then it's unit of account features are heavily compromised. It means that any long term financial measurement, from bond contracts to GDP measurements, to saving for retirement, it is almost impossible to calculate meaningfully. It distorts and in some cases removes price discovery from the market, leading to all the negative effects we see today; From stagnating economies to wealth inequality, environmental neglect to international conflict.